A Political Dream Turned Crypto Nightmare

In early 2025, Argentina’s promise of economic revival through tech and innovation collided with the volatile world of cryptocurrency. The LIBRA memecoin, once heralded as a “freedom-driven digital revolution” and promoted by President Javier Milei, has now become a high-profile scandal.

An Argentine federal judge has frozen the assets of U.S. businessman Hayden Davis and two crypto operators after prosecutors uncovered suspicious transactions linked to the token. Investigators believe the LIBRA project defrauded hundreds of investors, draining between $100 million and $120 million in just weeks.

(Source: Protos.com)

The Meteoric Rise and Crash of LIBRA

The Launch

On February 14, 2025, the token LIBRA launched under the slogan “Viva La Libertad”. It was touted as a symbol of Argentina’s new economic philosophy—private enterprise, deregulation, and market liberty.

Milei himself shared the token contract address on X (formerly Twitter), calling it “a reflection of freedom through blockchain”. Investors flooded in, sending the token’s value from nearly zero to $5.20 within minutes.

But the euphoria didn’t last. Within hours, the token’s value crashed by over 90 percent. Thousands of investors, many ordinary Argentines hoping to safeguard their savings amid inflation, saw their funds evaporate.

(Sources: Wikipedia (Spanish), Buenos Aires Herald)

The Investigation Heats Up

The Judge Steps In

Fast-forward to November 2025: Argentine Judge Alejandra Rodríguez issued an order freezing assets belonging to Hayden Davis and two other operators—Favio Camilo Rodríguez Blanco and Orlando Rodolfo Mellino.

Prosecutors revealed that Davis transferred $507,500 via Bitget, a major cryptocurrency exchange, shortly after appearing publicly with President Milei. The timing, they allege, suggests those funds were part of the profits siphoned off from LIBRA investors.

(Source: Protos.com)

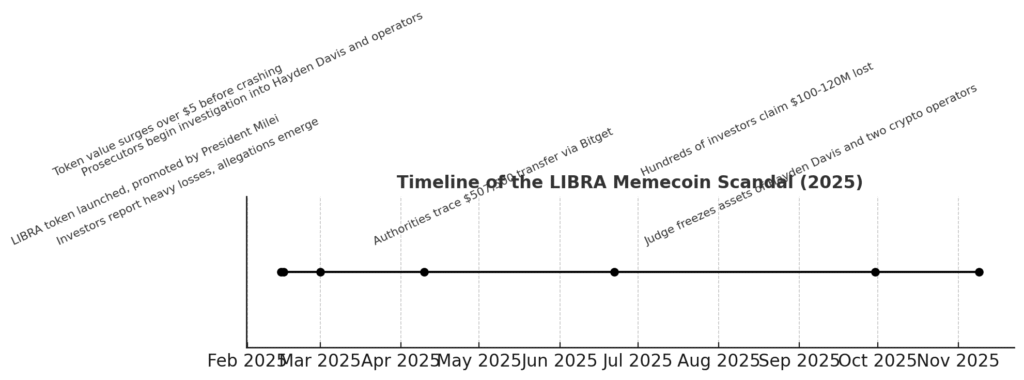

📅 Visual Timeline: The LIBRA Scandal Unfolds

(Chart Caption: Key events in the LIBRA memecoin scandal, from its launch to the asset freeze. Data compiled from Protos, Buenos Aires Herald, and court filings.)

Alt text: A horizontal timeline showing the rise, crash, investigation, and judicial freeze of the LIBRA token between February and November 2025.

| Date | Event |

|---|---|

| Feb 14, 2025 | LIBRA token launched and promoted by President Milei |

| Feb 15, 2025 | Token surges above $5 before collapsing |

| Mar 1, 2025 | Investor losses spark outrage online |

| Apr 10, 2025 | Prosecutors begin fraud investigation |

| Jun 22, 2025 | $507,500 traced via Bitget exchange |

| Sep 30, 2025 | Estimated losses reach $100M–$120M |

| Nov 9, 2025 | Judge orders asset freeze on Davis and two operators |

Who’s Who in the LIBRA Case

Hayden Davis — The American Connection

Davis, a U.S. entrepreneur and self-proclaimed blockchain innovator, met Milei during a private investor forum in Buenos Aires. Days later, LIBRA launched. Investigators allege Davis used the Bitget exchange to move funds offshore immediately following the meeting.

(Source: Fortune.com)

Favio Camilo Rodríguez Blanco & Orlando Rodolfo Mellino – The Crypto Operators

The pair are believed to have coordinated token marketing and liquidity management for LIBRA. Wallet analysis suggests they transferred large amounts from the project’s contract to private accounts before the token’s collapse.

President Javier Milei -The Political Catalyst

Although Milei denies direct involvement, his public endorsement on social media ignited the buying frenzy that fueled the token’s surge. Critics accuse him of blurring the line between private investment promotion and public influence.

(Source: Wired)

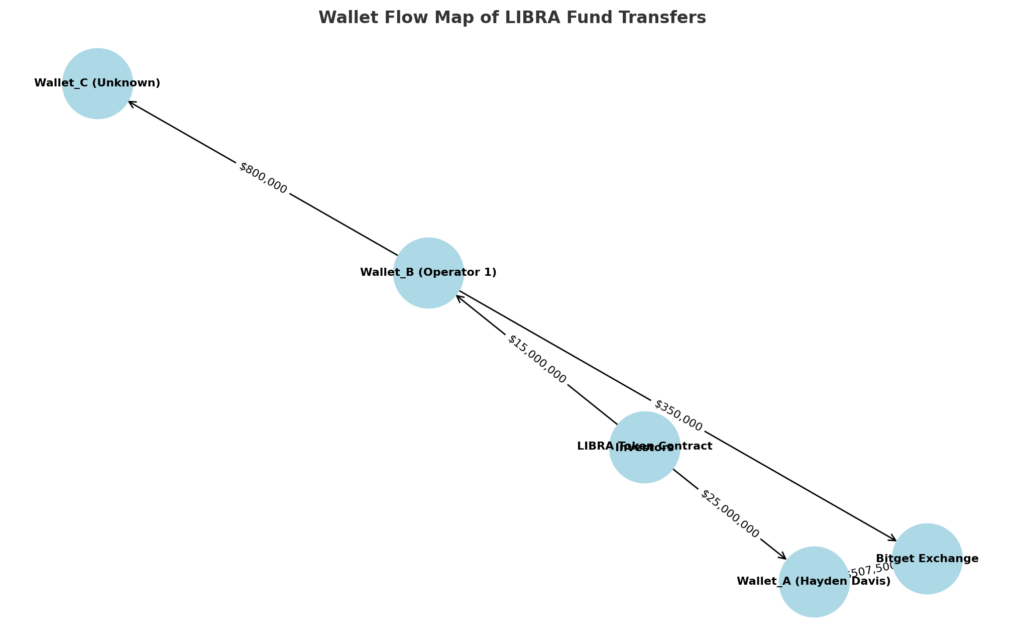

💰 Wallet-Flow Map: Tracing the Crypto Trail

(Chart Caption: Simplified flow of funds among LIBRA participants, showing transfers from investors to project wallets, operators, and Bitget.)

Alt text: A network diagram displaying wallet-to-wallet fund transfers in the LIBRA scandal, with Hayden Davis and Bitget at the center of outflows.

Key Flow Insights:

- Over $50 million in investor funds entered the LIBRA Token Contract.

- Roughly $25 million was routed to a wallet linked to Hayden Davis.

- An additional $15 million moved to a wallet controlled by an unnamed operator.

- Later, $507,500 was transferred through Bitget, allegedly by Davis, shortly after a meeting with Milei.

These flow patterns form the backbone of the prosecutor’s case—suggesting insider coordination and “pump-and-dump” tactics.

(Source: Bitget Exchange Reports)

Political and Economic Shockwaves

Fallout in Buenos Aires

The LIBRA scandal has thrown Argentine politics into turmoil. Opposition leaders demanded an impeachment inquiry, arguing Milei’s promotion of the token misled the public into believing it had state backing.

Meanwhile, Argentina’s Anti-Corruption Office opened a separate review into the President’s and his sister Karina Milei’s communications to assess potential conflicts of interest.

(Source: Buenos Aires Times)

Global Crypto Reaction

The scandal has rippled across global markets, with exchanges tightening listing rules for politically affiliated tokens. Experts now warn that government-linked memecoins carry heightened risk of manipulation.

(Source: The Guardian)

Lessons Emerging from the LIBRA Collapse

- Beware of Political Endorsements

When politicians—or celebrities—endorse tokens, hype can mask poor fundamentals. LIBRA’s rapid surge and collapse echo classic “pump-and-dump” patterns. - Demand Transparency in Tokenomics

The lack of publicly verifiable smart-contract audits or clear team disclosures allowed insiders to dominate early token allocations. - Track Wallet Movements

Blockchain transparency is a double-edged sword. While all transactions are visible, the absence of verified identities enables obfuscation of ownership. - Enforce Stronger Crypto Regulation

The LIBRA debacle has spurred calls for Argentina’s securities regulator (CNV) to implement real-time monitoring of token launches and investor safeguards.

(Source: Forklog.com)

What‘s Ahead for LIBRA and Argentina

The Road to Justice

Investigators are now focusing on cross-border cooperation with Interpol to trace remaining funds. Asset freezes are only the first step; restitution for victims could take years, depending on crypto tracing outcomes.

The Future of Crypto Regulation in Argentina

Experts predict Argentina will soon follow the EU’s MiCA framework or Brazil’s crypto-asset oversight model, enforcing stricter KYC/AML protocols and mandatory project disclosures.

(Source: CoinDesk)

Restoring Investor Confidence

Financial analysts argue Argentina must balance its pro-innovation stance with consumer protection. Without this, investor confidence—and the nation’s credibility may take years to rebuild.

Conclusion

The LIBRA scandal is more than a story of one failed token—it’s a reflection of how fast hype, politics, and technology can collide in the digital economy. The frozen assets of Hayden Davis and his associates mark a symbolic turn toward accountability in crypto finance.

Yet, for thousands of investors who believed in Milei’s vision of economic liberty, the dream turned into one of the country’s most expensive cautionary tales.

The message is clear: in the crypto world, freedom without responsibility can quickly become chaos.