In the crowded DeFi world, yield opportunities that aren’t obvious traps are precious. Yet Mint Club just dropped something that has every yield hunter double-checking their wallet. They’ve launched staking pools for $RUNNER and $MT, offering eye-watering APRs: 461.11 % for $RUNNER → earn $MT, and 73.76 % for $MT → earn $RUNNER. Yes, over 460 %. In a sea of 5–10 % yields, that’s screaming hot.

Because I roam across Base, Ethereum, and everywhere in between, I dove in. Mint Club isn’t a flash in the pan—it’s already known for bonding curve token/NFT creation and automated markets. With these pools live, the ecosystem just got turbocharged for yield hunters. Below, I break down exactly what’s happening, how it works, and why you might want to sprint in.

🚀 Launch Overview: How Did We Get Here?

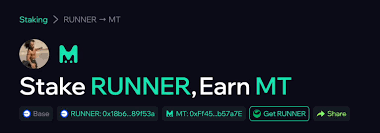

On September 19, 2025, Mint Club’s official X account lit up with teaser posts about tokens “running into wallets.” (X (formerly Twitter)) By 11 AM EST, the pools went live: stake $RUNNER to earn $MT, or stake $MT to earn $RUNNER. (Mint Club)

- For $RUNNER stakers: 461.11 % APR, backed by a $3,000 $MT reward pool over 30 days. (X (formerly Twitter))

- For $MT stakers: 73.76 % APR, supported by a $2,000 $RUNNER reward pool over the same window. (X (formerly Twitter))

These reward pools are proportionally distributed among stakers. As more people join (raising the TVL), the effective APR will likely decline—so early entrants get the sweetest yield. (You can stake here: RUNNER → MT) (Mint Club)

While these yields are wild, they align with DeFi’s usual early-adopter incentives. Low TVL, high reward pools, and incentive alignment help bootstrap liquidity. That said—this is not “set it and forget it.” Keep a close eye on how APRs evolve.

Bonding Curves 101: Why Mint Club’s Approach Matters

To understand what makes Mint Club unique, you need to grasp bonding curves. In simple terms, a bonding curve is a mathematical function that maps token supply to price. As more tokens are minted, the price is pushed upward; as tokens are burned or redeemed, the price drops. (Coinbase)

These curves underpin many modern token launch models and automated market maker (AMM) approaches. (Cointelegraph) Because Mint Club is built around bonding curve logic—for both tokens and NFTs—the protocol already has a built-in dynamic pricing engine. In effect:

- $MT powers governance, fees, and the economic backbone of the ecosystem. (Mint Club)

- $RUNNER is more playful—a memecoin launched via bonding curve, now serving as a “run-to-earn” token (staking to earn $MT).

- The new staking pools tie into the same internal mechanics: you stake one token, earn another, looping back into the bonding curve economy.

In short: staking isn’t just yield farming—it’s fueling the core protocol.

For more on how bonding curves work and their risks (e.g. front-running, smart contract bugs), see this guide on What Are Bonding Curves (dYdX) or the Cointelegraph explainer. (Cointelegraph)

APR Deep Dive: Where Do Those Numbers Come From?

Let’s break down the math (in simplified fashion):

- APR = (reward pool / total staked value) annualized

- With a $3,000 MT reward pool distributed over 30 days to all $RUNNER stakers, if you’re an early contributor (say 1 % of the staked amount), your share could be substantial.

- The 73.76 % APR for $MT stakers is more “steady high yield,” since the $RUNNER pool is proportionally lower relative to the staked base.

These APRs are variable. As more capital enters, APRs will drop. That’s standard in DeFi staking pools. What’s key is acting early—before TVL floods in.

To put this in context: many CeFi or DeFi protocols cap yields in the teens or low double digits. Mint Club’s rates are extreme outliers—designed for high-risk, high-reward participants.

How to Stake: Step-by-Step 🧰

- Go to mint.club and connect a Base-compatible wallet (e.g. MetaMask configured for Base).

- Navigate to “Staking” → choose either: stake $RUNNER to earn $MT or stake $MT to earn $RUNNER.

- Approve the token (if first time), enter the amount you want to stake, confirm the transaction.

- Rewards begin accruing immediately (no fixed lockup).

- Claim anytime. The UI shows real-time accruals and historical data.

- Example: Stake RUNNER → earn MT (Mint Club)

Gas fees on Base are minimal, making this accessible. Also, you can loop (stake rewards back) if you want to compound—but be cautious and monitor TVL shifts.

Note: I experienced occasional wallet glitching on mobile early. For safety, stake from desktop first.

Why This Move Matters for DeFi Degens & Ecosystem Growth

Mint Club’s staking rollout is more than flashy APRs—it’s a signal of maturation. Here’s why:

- Liquidity bootstrapping: High yields attract capital; that improves spreads, usage, and token velocity.

- Token utility: $RUNNER shifts from memecoin to yield-bearing asset; $MT strengthens as governance and core token.

- Composable DeFi: The protocol becomes interoperable, letting other apps or strategies lean on these curves and stakes.

- Ecosystem expansion: More liquidity means more tokens/NFTs can be launched on Mint Club, which in turn draws developers and users.

Across social channels, chatter is already lit. Users joke about “free cardio” as APRs keep pumping. Organic hype helps. (Check Mint Club’s X for live posts.) (X (formerly Twitter))

That said—this is still experimental. Smart contract auditing, token dump pressure, front-running, and governance dilution are real threats. Proceed with eyes wide open.

What’s Next? Looking Ahead

Here’s what I’m watching:

- Post-pool mechanics: Will Mint Club introduce restaking, auto-compounding, or new reward cycles?

- Cross-chain bridges: Could $RUNNER/$MT migrate to EVMs beyond Base?

- Gamified staking: Maybe “run-to-earn” features tied to on-chain activities (NFT quests, on-chain challenges).

- Governance & sustainability: How will $MT holders vote on reward size, inflation, and dilution?

For now, I’m splitting my stake: part in the pool, part waiting to trade or reposition. Use small amounts initially, track APRs, and be ready to pull out if things shift.

Final Lap: Your Move in the DeFi Race

Mint Club’s $RUNNER / $MT staking launch isn’t just hype—it’s a calculated push into yield mechanics baked into a bonding curve protocol. 461 % APR? 73 % APR? In 2025, that’s rocket fuel. If you’re comfortable with higher risk, this is low-friction access to aggressive staking strategies.

Will you jump in now, or wait for the yield fallout? Let me know your thoughts and wildest APR stories. Until next time—keep your wallet warm and your gas low.

References & Further Reading

- Stake RUNNER → Earn MT (Mint Club) (Mint Club)

- Mint Club Staking home page (Mint Club)

- What Are Bonding Curves (dYdX) (dYdX)

- Bonding Curves in DeFi (Cointelegraph) (Cointelegraph)

- Bonding Curves and dynamic pricing (SpeedRunEthereum) (Speed Run Ethereum)

- Understanding Bonding Curves (Medium / QuillAudits) (Medium)

- Implementation & security of bonding curves (Resonance) (resonance.security)

- Bonding Curves explained (Yos.io) (Yos Riady · Software Craftsman)

- Adaptive curves for AMM (ArXiv) (arXiv)

- Yield tokenization & bonding curves in DeFi (ArXiv) (arXiv)