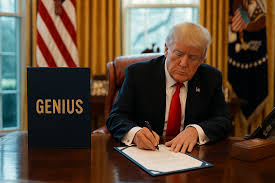

Alright, crypto fans and curious folks, let’s talk about a massive moment that just went down. On July 18, 2025, President Donald Trump signed the GENIUS Act into law at a lively White House ceremony, and it’s a game-changer for the world of digital currency in the United States. This is the first major federal legislation to tackle cryptocurrency, specifically stablecoins, and it’s got everyone buzzing. So, let’s break down what the GENIUS Act is, why it’s a big deal, and what it means for the future of money in America.

What’s the GENIUS Act All About?

The GENIUS Act, or Guiding and Establishing National Innovation for U.S. Stablecoins, is a groundbreaking law designed to regulate the $250 billion stablecoin market. If you’re new to crypto, stablecoins are digital currencies pegged to stable assets like the U.S. dollar, making them less volatile than wild cards like Bitcoin or Ethereum. They’re like the reliable workhorse of crypto, used for everything from cross-border payments to DeFi (decentralized finance) transactions.This law lays out a clear framework for stablecoin issuers, setting rules to ensure transparency, consumer protection, and financial stability. It involves oversight from heavy hitters like the Federal Reserve and the Office of the Comptroller of the Currency, which means stablecoins are about to get a lot more legit. Key requirements include:

- 1:1 Reserve Backing: Stablecoin issuers must back every token with an equivalent amount of U.S. dollars or Treasury bills, verified by monthly reserve reports.

- Consumer Protections: If an issuer goes under, stablecoin holders get priority over other creditors, so your money’s safer.

- Anti-Money Laundering Compliance: Issuers have to follow strict rules to prevent fraud and illegal activity, making the ecosystem more trustworthy.

This landmark legislation sets up a regulatory framework for the $250 billion stablecoin market, establishing clear rules for issuers, consumer protections, and oversight by federal agencies like the Federal Reserve and the Office of the Comptroller of the Currency. It’s a big step toward making stablecoins more mainstream, trustworthy, and accessible for everyday use.

The Signing: A White House Celebration

The Signing: A Moment to Remember

The East Room of the White House was packed with about 200 people, including GOP lawmakers, crypto industry leaders from companies like Coinbase, Tether, and Robinhood, and even some tech enthusiasts cheering from the sidelines. Trump, in classic form, cracked a joke about the GENIUS acronym, saying, “They named it after me!” The crowd loved it, and he went on to call the bill a “massive validation” of the crypto industry’s potential. He’s been vocal about making the U.S. the “crypto capital of the world,” and this law is a cornerstone of that vision.

Getting here wasn’t easy, though. The bill faced a bumpy road in Congress, with some conservative Republicans holding it up over concerns it didn’t address other priorities, like banning a central bank digital currency. After intense negotiations—Trump reportedly got on the phone himself to sway holdouts—and a grueling nine-hour procedural vote (yep, a record), the House passed it 308-122, with the Senate following at 68-30. Bipartisan support like that for crypto? That’s rare.

Significance:

So, why should you care? The GENIUS Act is a game-changer for a few reasons:

- Regulatory Clarity: For years, the crypto industry has been begging for clear rules. Without them, companies faced uncertainty, and consumers were left vulnerable to scams or unstable platforms. The GENIUS Act sets guardrails, requiring stablecoin issuers to back their tokens 1:1 with reserves like U.S. dollars or Treasury bills, publish monthly reserve reports, and comply with anti-money laundering laws. This transparency boosts trust and could bring more people into the crypto fold.

- Mainstream Adoption: Stablecoins are already used for fast, low-cost transactions, especially in cross-border payments. By making it easier for banks, credit unions, and other institutions to issue stablecoins, the law could integrate digital currencies into everyday finance. Imagine using stablecoins at your local coffee shop or for online purchases—it’s not as far-fetched as it sounds.

- Economic Impact: Trump and supporters argue the law will drive investment and innovation, positioning the U.S. as a global leader in digital assets. Treasury Secretary Scott Bessent even predicted the stablecoin market could hit $3.7 trillion by 2030. Plus, by requiring reserves to be backed by U.S. Treasuries, the act could strengthen demand for U.S. debt and reinforce the dollar’s role as the world’s reserve currency.

- Consumer Protection: The law prioritizes consumer safety by ensuring stablecoin issuers have robust reserves and comply with strict regulations. If an issuer goes bankrupt, stablecoin holders get priority over other creditors, giving users a safety net.

The Controversy: Conflict of Interest Concerns

Not everyone’s popping champagne. Some Democrats, like Rep. Maxine Waters and Sen. Elizabeth Warren, raised red flags about potential conflicts of interest. Trump’s family has deep ties to the crypto industry, particularly through World Liberty Financial, a company that launched its own stablecoin, USD1. Trump reportedly earned $57.35 million from token sales in 2024, and the company’s market cap is $2.2 billion. Critics argue the GENIUS Act lacks provisions to prevent the president and his family from profiting off the legislation, even though it bans members of Congress and their families from doing so.

On the flip side, supporters like Garrick Hileman, a crypto researcher, argue that these concerns belong in the ethics domain, not a payments bill. The White House has denied any conflicts, stating Trump’s assets are managed by his children in a trust. Still, the optics have sparked debate about transparency and accountability.

What’s on the Horizon?

The GENIUS Act is just the first step. Two other crypto bills passed the House during “Crypto Week”: the CLARITY Act, which defines whether digital assets are securities or commodities, and the Anti-CBDC Surveillance State Act, which blocks the Federal Reserve from issuing a central bank digital currency. Both are headed to the Senate, where their fate is less certain.

Meanwhile, the crypto industry is buzzing with optimism. Bitcoin hit a record high above $120,000 this week, and companies like Circle and Coinbase are seeing gains. The SEC, under crypto-friendly Chair Paul Atkins, is already exploring how stablecoins can be used in securities markets, hinting at more innovation to come.

The Big Picture

The GENIUS Act is a milestone that could reshape how we think about money in the digital age. It’s not perfect—critics say it doesn’t go far enough on consumer protections or addressing conflicts of interest—but it’s a start. For crypto fans, it’s a sign that the U.S. is serious about leading the blockchain revolution. For skeptics, it’s a reminder to keep an eye on how power and profit intersect.

What do you think? Is this the dawn of a new era for crypto, or are the risks too high? Drop your thoughts below, and let’s keep the conversation going!

Sources: CBS News, ABC News, Reuters, Axios, Forbes, and posts on X

Trump signing the GENIUS Act is massive for crypto! A Strategic Bitcoin Reserve

But will small investors benefit, or is this just for whales?

Anyone know more about the rollout?

The article says it fueled BTC’s $123K run—think we’ll see $150K by year-end?

Thanks to President Trump for and the US for starting this. Other countries should follow